Fight fraud and harness data

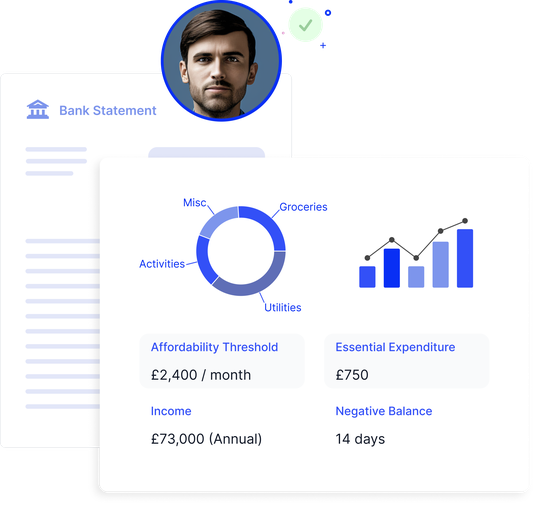

Stop application fraud before it becomes costly whilst gaining instant affordability insights directly from consumer bank statements.

We’re trusted by the world's leading companies

Utilise actionable insights based on transaction, account & financial information extracted from documents.

Save resources by discarding fraudulent, risky or valueless applications at the very start of a consumer application review.

Automate tedious manual operations tasks to remove the risk of human error. Cut back on costs by streamlining application reviews.

Intelligent document analysis with Fraud Finder

Our document analysis tool detects application fraud via a secure portal or an easy-to-integrate API.

Font detection tests demonstrate exactly where original information has been changed by flagging irregular fonts. Many fonts used by financial institutions are protected & unavailable to the public.

X-ray image analysis checks the version history of any document and highlights imperfections in the document’s structure.

We can analyse the software used to create document versions, the date the document was modified and trace its QR code to its original source.

All of these tests are performed with speed, and at scale. Give your consumers a seamless application process with minimum turnaround times.

Discover how to find fraud in financial documents >

Fraud and data

Transactions analysis

Standardise all bank statements, regardless of whether your applicant chooses to connect to Open Banking or not, into a JSON file.

Validate information

Speed up onboarding and confirm account holder information with speed and efficiency.

Reduce instances of spelling mistakes & missing data.

Automate time-draining tasks across thousands of documents.

Boost productivity 10x and expand your processes with automation.

Incorrect or timely data processing causes friction. Remove the hiccups.

Unlock error-free risk assessments and prevent fraud

We'll provide a short no-obligation demo of each element of our fraud tech, book below: