Case study: Knight Frank

Reducing risk exposure for one of the UK's largest letting and Real Estate companies

Headquartered in London, Knight Frank has more than 480 offices across 57 territories and operates in locations where their clients need them to be. They provide a worldwide service that’s locally expert and globally informed – one that allows them to connect people and property, perfectly.

They believe that taking a personal approach is crucial when interacting with their clients and this inclusive approach fits perfectly with the Homeppl mission.

The Challenge

The Knight Frank UK letting operation welcomes a diverse range of tenants including internationals, students, and High-Net-Worth individuals, but their tenant referencing solution was old-fashioned and meant that tenants faced unnecessary barriers in the due diligence process.

They were also exposed to increasingly sophisticated fraudsters as their referencing provider didn’t have the advanced technology required.

Knight Frank objectives were to eliminate customer friction, lift approval rates, and enhance fraud protection.

The solution

By moving to Homeppl, Knight Frank received a more comprehensive reference, allowing its operations team to function more efficiently and cut costs.

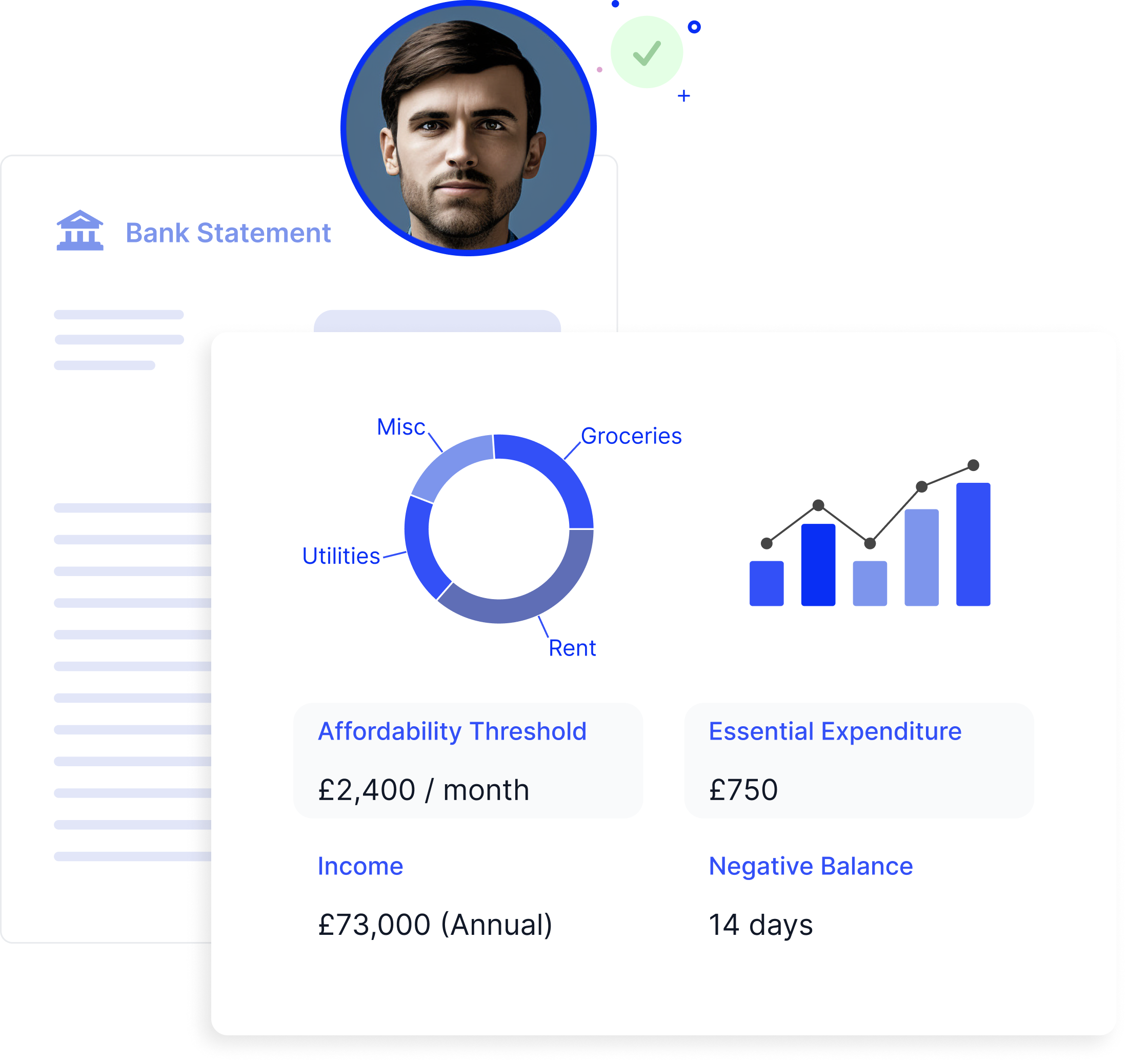

Homeppl took away the burden of credit reference agency dependency and Open-Banking-only analysis, replacing it with a solution that assesses the true transactional ability of every type of tenant from any nationality.

One of the main benefits to Homeppl’s technology is its ability to adapt to the risk appetite of its customers. The system is automated, financial assessment decisions are based on over 150 different data enrichment, fraud detection & stress tests. Essentially, signals can be weakened or strengthened depending on how risk averse one wants their due diligence to be.

Catching fraud and protecting reputation

UK letting agents are exposed to increasingly sophisticated fraudsters and failure to identify it can have a hefty financial impact on you and your landlords whilst causing reputational damage.

A staggering 1 in 66 UK tenants attempt to commit fraud when trying to rent. Our unique fraud tests identify these fraudsters and expose them.

Homeppl found more fraud cases in the 4 month trial with Knight Frank than their previous referencing supplier found in 6 years. Learn more about our tenant referencing solution here.

"Our previous experience had been that referencing companies adopt a 'one size fits all approach' which is frustrating for the tenants and creates friction in the process. Homeppl have a truly flexible approach which fits around the tenant and draws on a range of data sources to assess and authenticate their true financial position, meaning that more good tenants are approved without any additional risk”

"We’ve been most impressed with Homeppl’s ability to identify fraudsters. They have done this on numerous occasions and saved us thousands of pounds, while protecting our reputation with our landlords."

The results

High approval rates

17.5% increase in Knight Frank approval's rateAccurate declines

2% of all transactions accurately detected as fraudulent and prevented.Repuation protection

100% reduction fraud. As such, a 100% reduction in legal costs, rent loss, and damages.