Fake bank statements take centre stage as the most significant contributor to fraud in November.

Another month comes and goes and the Homeppl fraud fighters have been ever busy.

Homeppl flagged over £1,585,068 in fraudulent tenancy applications in November.

Interestingly, the vast majority of tenancy fraudsters edited bank statements to try and secure rental contracts on false pretences. In fact, 96% of all cases this month included modification of bank statements!

In addition, 24% of the fraudsters we flagged had submitted a fake passport as part of their application. 29% had provided fake or incorrect company information and we identified 4 cases in which company website domains had been recently created.

The more fake documents submitted the more at risk tenants are to default down the line. A default will now cost landlords around £40,000 in legal proceedings and eviction costs.

Unsurprisingly, we also flagged 3 cases of fraud who have previously been flagged by us before for other clients.

Homeppl have built a considerable fraud database, making it incredibly easy for us to highlight repeat offenders.

UK fraudster profile for November

Homeppl have made the decision to inform letting agents and Build-to-rent developers of the latest fraud trends and updates that we discover on a monthly basis to continue to highlight the financial risk attached to these applications.

November's fraudster profile:

For the 2nd month in a row, East London has been the epicentre of tenancy fraud. A stark warning to the letting agents who operate primarily in that area. Whilst East London accounts for 50% of all current cases in London, South West and North West are the next most affected with 17% of all cases each.

Surrey and Essex have proven to be fraud hotspots in November, sharing a collective 30% of all UK cases.

For the second month in a row we've seen the average claimed income by fraudsters shoot up. The average claimed income for November was £112,000 compared to last month's £95,000.

What else has changed from last month?

Fraudsters are getting younger, with the average age of a fraud claim now 30 years old. The majority of cases, as ever, are committed by tenants with UK passports.

Fraud Spotlight

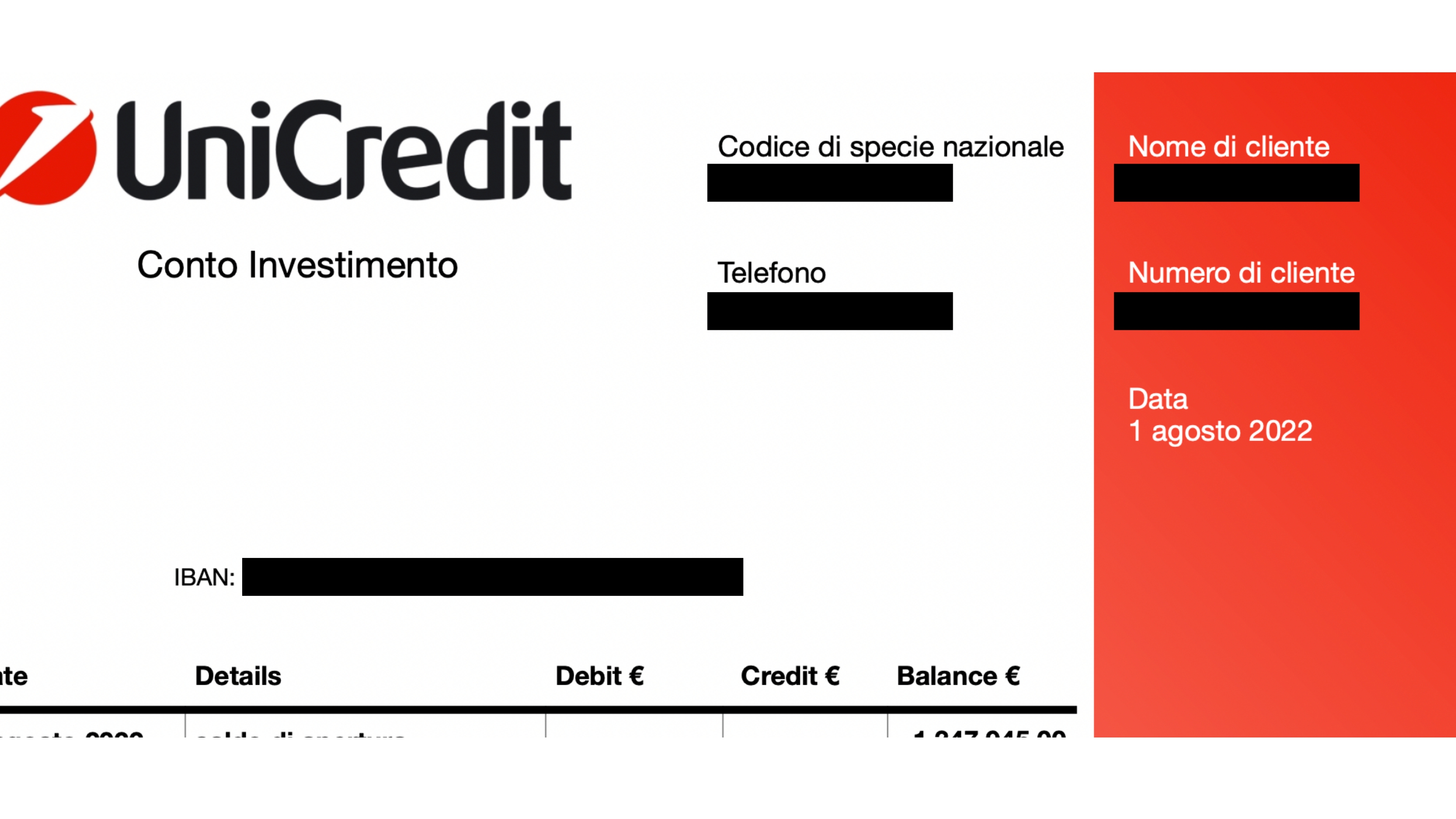

For this month’s fraud spotlight we examine the fake bank statements of a tenant who tried to defraud one of our clients for a rental contract worth £240,000.

In the image above we see an investment account provided as evidence of affordability for a property in London.

Despite the statement date presenting as August 2022, in closer inspection, our fraud detection tests uncovered that:

1) The original document was first produced way back in 2017, 5 years ago.

2) Our versions history test was able to uncover every version of this document, that had been modified and used on multiple occasions.

Nothing gets past us!

New product alert: document analysis & financial data analysis through a web app or API

Fraud Finder, Homeppl's latest product, conducts intelligent document analysis by extracting & analysing financial data whilst flagging fraud in financial documents. It assesses affordability, underwrites risk, detects fraud and qualifies your customers.

We are exposing our industry-leading fraud technology and can be used by letting agents, real estate risk assessors and mortgage brokers and anybody who assesses documents for an application.

Check a bank statement, check 10.. try it for free now...

To read the latest Fraud Monthly round up for December, click here.