To understand a consumer's residential history, letting agents, mortgage brokers, and lenders use utility bills as proof of residence. A person's credit history is inextricably linked to residence, so wherever you move, your stamp of creditworthiness, which many lenders use to grant or deny financial access, follows you along.

However, utility bills have become a tool for fraudsters to scam companies, conceal their financial risk, muddy a person's credit history, and appear to be the perfect borrower. Forgeries of utility bills can be used by identity thieves to steal money or personal information.

There is no doubt that thieves and fraudsters now have several technology-led tools to be able to fake utility bills and make them appear authentic. But we must also talk about opportunity. Many identity thieves understand that lenders and other financial service providers deal with a great volume of credit applications daily. Especially in 2023, where the majority of Europe and the United States are experiencing an ongoing cost of living crisis as a result of war and post-pandemic economic activity. Fraudsters are aware that many lenders still review documents manually, only picking up fraudulent modifications that can be seen with the human eye. Tighter controls at the point of application are needed.

Furthermore, bad actors may use fake utility bills to obtain money through programs like the Small Business Bounceback Programme.

There are tons of websites available that sell fake bill templates for a small fee. Alongside the many online tools that help fraudsters create fake utility bills, technology and automation is essential in the credit checking process.

This is an ‘all you need to know’ guide on the shady world of fake utility bills.

What is the motive behind creating a fake utility bill?

Homeppl finds A LOT of fraud. When reviewing the fraud catches that have come as a result of the manipulation of utility bills, the most common case we find is the removal of one address that is later replaced with another. In other words, the consumer will conceal their actual residency and replace it with a fake one.

Why? A couple of reasons:

To hide bad credit

When opening bank accounts for credit or debit cards or taking out a personal or business loan, the due diligence team will require original PDF copies of bank statements and utility bills. The provider will run a credit check on the information provided as a first port of call. The chances of gaining financial access are less likely if you have bad credit, bankruptcy notices or CCJs on your record. Your current and previous addresses are a central component of credit checks.

Banks and lenders also ask for utility bills to verify a loan applicant's identity, financial standing, and ability to pay bills on time. Late or delinquent utility bills can impact an individual's credit score, making it harder to obtain a loan. By paying bills on time, a borrower can demonstrate responsibility and potentially secure a loan with favourable terms.

Here’s a video of a consumer we caught faking their utility bill in Dublin, Ireland. The name and address here has likely been changed due to a weighty CCJ on the applicant's credit file, which is attached to the residency the consumer has tried to shield from the lender:

Our advanced document analysis tool, Fraud Finder, which has the functionality to retrace and present every modification and version of a single document, has caught this utility bill faker red-handed. This is not something a manual risk or ops team could have seen with the human eye.

This is particularly concerning, where in the UK, fraud under the value of £1,000 costs £19,793 on average to deal with. This number only increases the higher the value of the fraud. Mortgage fraud alone in the UK leads to over £1bn in fraud losses per year. Access to mortgages is just as much predicated on the authenticity of documents as small personal loans or credit cards.

Identity theft

Fake water, electricity and energy bills are created to also take out a line of credit under someone else’s identity altogether. The UK saw a 45% increase in identity fraud and application in 2022 and CIFAS, the Credit Industry Fraud Avoidance System argue that it is going to get worse in 2023, due to the tough economic conditions in which more individuals are looking for more credit.

Fraudsters tend to impersonate unwitting consumers with long credit histories to demonstrate credible repayment history but have started using phishing scams playing on the energy crisis by offering fake energy discounts. Identity criminals would use templates and fake utility billing documents from well-established UK energy and water providers to offer exceptional deals for energy switches, only to steal personal information and use it for entirely nefarious activity.

The alarming truth is that by merely typing ‘fake energy bill’ into Google will bring up a list of companies and websites that sell common energy company utility bill templates. Luckily for clients of Homeppl, our Web app and API document analyser are able to separate the templates from the original and authentic bills issued by the companies themselves.

Why else might lenders and banks wish to review utility bills during a loan application process?

Banks and lenders want to build a full financial and risk profile for each consumer that they approve so they can set interest rates appropriately and ensure they’re not taking on risky customers likely to default. Paying your energy bills on time every month can signal that you are a trustworthy borrower.

Another reason institutions will ask for these documents is if they’re assessing thin-filed applications. A ‘thin-filed’ applicant is one with little UK credit history. For example, post-university students who have got their first jobs and applied for their first credit card. Regular utility bill and phone contract payments signal to lenders that you are someone worth extending a line of credit to.

Fake documents, including utility bills, misleads financial providers into providing credit where they otherwise wouldn't have, putting those institutions at significant risk.

How to spot a fake energy bill

Fake documents are becoming more common as more people are needing more access to financial products during the cost of living crisis. Research conducted by us here at Homeppl shows that up to 10% of consumer applications can be fraudulent. That’s why its essential for lenders to boost their fraud prevention functions at the point of application so manipulated applications can be quickly discarded.

Some identifications can be made by a human team if their due diligence and focus did not waver with time. For a company processing documents at scale, this is almost impossible to be the case. Human error must always be accounted for. Some of these key things to spot are:

Spelling errors

Unusual spaces and misalignments

Incorrect date and date format

Incorrect equations of numbers on the bill

Rounded numbers

Font size and type discrepancies

Image and logo resolution

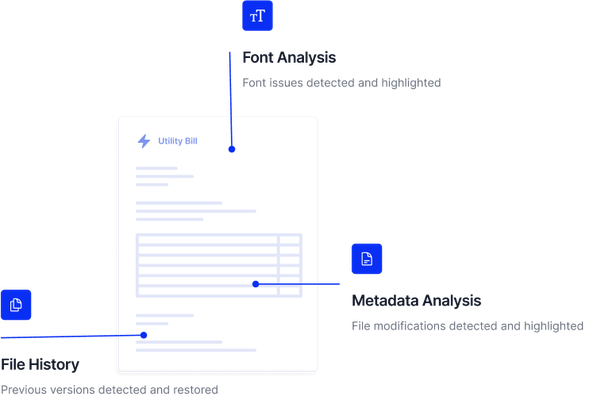

Using a technology-led application fraud prevention system like Homeppl’s Fraud Finder can find all of the above modifications in less than 3 seconds. Implementing a system like this can save up to 200 hours a week in manual document processing.

Some modifications that human document review processes will simply miss are:

The deletion and replacement of original information with false new information

Font family mismatches

Barcode analysis

Differences between the document creation date and its modification date

Any anomalies in the document’s structure

Again, these are all things easily picked up on at scale via the Fraud Finder web app and API.

Trial and test this technology yourself for free today by booking a tech demo. Companies that use Homeppl to assess risk qualification typically see an ROI of 33x due to the substantial savings in operations costs as well as significantly reducing fraud loss and protecting lender reputation.

What to read next:

How to spot an edited bank statement