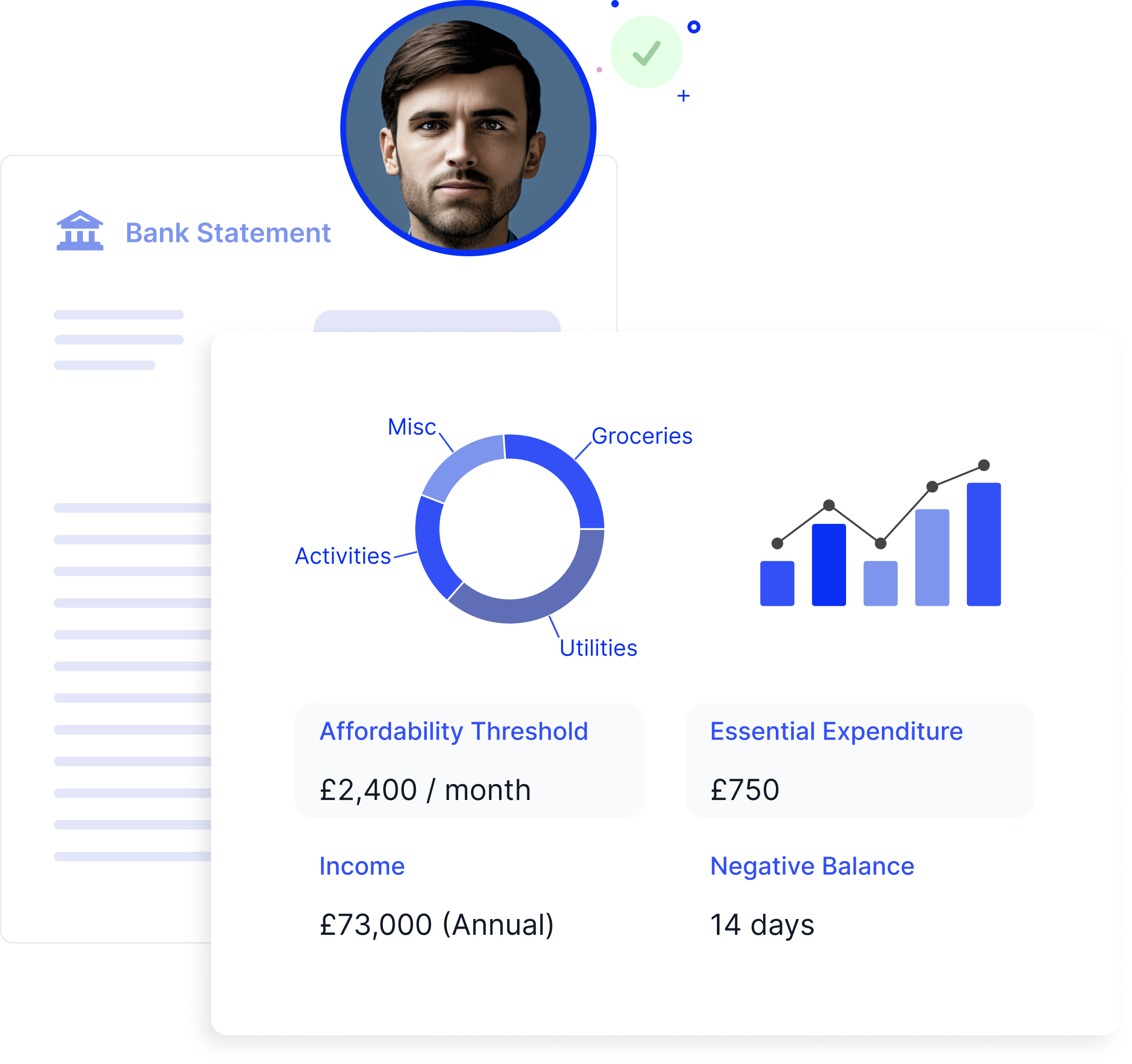

Turn raw banking data into actionable insights

Gain an in-depth understanding of each applicant’s financial behaviour and affordability for unparalleled risk insights based on facts and data.

We’re trusted by the world's leading companies

A more granular analysis of consumer spending means you can detect risk factors such as low payments, overdraft usage & excessive gambling.

Better data leads to better decisions. The more data & insights on each applicant, the higher the accuracy and confidence in applications.

Replacing cumbersome manual reviews of financial and residential information with a digital experience boosts operational efficiency.

Financial data enrichment

Outdated credit checks are not enough to truly assess consumer risk against the backdrop of a global economic crisis. Take better control over financial underwriting with advanced affordability analysis.

We turn any bank statement into unified code and create a financial report packed with useful payments, income, spending & saving analyses.

We’ve assessed the financial statements of countless applicants. Flag financial behaviour that has led to risky outcomes before.

Open Banking is now widely considered the most secure, efficient and accurate form of financial assessment.

Cross-examine income sources, bank balances and payment activity with employment information declared in an application.

Discover more about the benefits of financial data enrichment >

risk and affordability

Behavioural and device enrichment

“We’ve been most impressed with Homeppl’s ability to identify fraudsters. They have done this on numerous occasions and saved us thousands of pounds”

Kelly Fraser, Associate, Knight Frank

Sectors we serve

Protect against the growing risk of fraud in consumer, business loan & vehicle finance applications.

Expand financial access to more quality customers by assessing thin-filed and international applicants.

Scale your business by enhancing efficiency with automation & customise risk appetite to suit you.

5% of properties are rented to fraudsters. Check for ID, financial and residential suitability at speed.

Simplify your risk and affordability assessments

We'll provide a short no-obligation demo of each element of our fraud tech, book below: