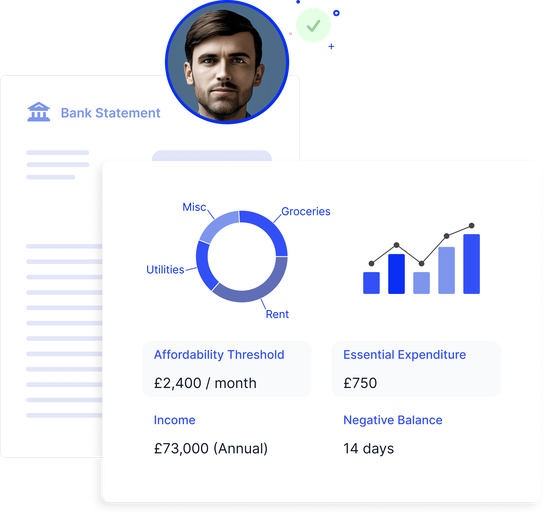

Extract bank statement data

Instantly extract, group and analyse transactions and income data from any financial document for granular, more conclusive, affordability assessments.

We’re trusted by the world's leading companies

Hours of manual labour relating to the review of consumer applications that can be automated and made far more efficient with our technology.

Consumer applications for financial products are reviewed globally every year. Homeppl finds up to 10% of current client applications contain fraud.

Losses due to UK financial fraud in the first half of 2022. Optimise your risk decisioning with instant verification of your customers’ transactions.

Simplify affordability assessments with banking data

Unlock a wealth of financial data too difficult to gather and analyse manually.

Standardise all bank statements, regardless of whether your applicant chooses to connect to Open Banking or not, into a JSON file.

Get an instant report detailing all monthly income sources. See insights on income vs expenditure in seconds.

Supercharge your verification process by no longer discarding applications that refuse to connect to Open Banking.

All transactions are automatically grouped and categorised. Flag suspicious payments and unusual transactional activity.

Fraud and data

Transactions analysis: Open banking API

“This tool is very intuitive and quick. This is so exciting, it's a game-changer”

Piero Bassu, General Manager, RVU

Sectors we serve

Protect against the growing risk of fraud in credit applications during a global cost of living crisis.

Expand financial access to more quality customers by assessing thin-filed and international applicants.

Scale your business by enhancing efficiency with automation & customise risk appetite to suit you.

5% of properties are rented to fraudsters. Check for ID, financial and residential suitability at speed.

Read more about extracting data from bank statements

Powerful affordability analysis generated in seconds.

Make better decisions with instant access to up-to-date transactions data

We'll provide a short no-obligation demo of each element of our fraud tech, book below: