Whilst fraudsters are finding new and more technologically advanced methods to avoid detection, they're still no match for Homeppl.

Our unique technology can detect 100% of fraudulent applications and one of the most significant elements of our technology stack is our document analysis. It is commonplace to require a bank statement or a payslip when seeking to rent a property, apply for a credit card or loan, or even secure a mortgage or car financing.

It's essential for the financial service provider to accurately assess the consumer risk attached to each application and check for bank statement or payslip fraud. Did you know that 5% of properties in the UK are rented to fraudsters? Or that almost 50% of all motor finance fraud in the UK stems from the manipulation of financial documents? According to CIFAS, 1 in 13 Brits admitted to committing first-party form fraud last year when applying for financial products. This is due to a subpar standard of referencing and a lack of verification technology in these industries .

Homeppl's Fraud Finder, an advanced document analysis and fraud detection tool can instantly detect manipulations and edits to bank statements, payslips, tax returns, invoices, pension letters and student letters in seconds.

How we detect fake bank statements and fake payslips

Appearance.

The first and most telling sign of a fake bank statement is its appearance. Inconsistencies in fonts, text size and even the bank's logos are modifications we regularly detect. Fraudsters tend to get careless with these details, so it is essential to look out for them as this is your first warning sign.

The font and font sizes used across an original bank statement will remain consistent. Furthermore, the document's resolution is vital; when modifying a bank statement, the quality will tend to decrease, which is significant to look out for.

However, scanning a document with the naked eye is not enough these days. You can look in detail at the bank logo for instance and not spot anything wrong. Homeppl have digital image X-ray technology that can tell when an image or new text has been layered over an original source.

Authentic bank statements will only have one document layer

Our fraud prevention software picked up that this particular bank statement had 7 different fonts which were clearly different to the ones used on typical HSBC bank statements. It had a number of layers placed over the original statement issued by HSBC.

We also found that the software used to edit the bank statement was an application called CorelDraw (We can pick this up from the metadata of the statement or payslip).

On this particular statement, the barcode in the top left hand of the statement did not match the original address this barcode was assigned (yep, we can decode that too!).

See some of our fake bank statement fraud catches in action

Here's an example of how a loan applicant faked their bank statement by changing the address to hide bad credit:

Here's an example of how someone fabricated a payslip to inflate their monthly salary.

Our 'edit versions history' test can recover every single version of a document ever produced. This one had 14 previous versions (!) before the final version was submitted to us as part of an application:

Catching Application Fraud

Another telling sign of application fraud is whether the numbers and icons on the page are aligned correctly and consistently, which they should be if issued by a bank.

We've written quite extensively on the different types of fraudsters that are currently in operation across Europe. You have cases of both amateur and professional document modification.

As with the amateur falsifications on a bank statement, classic errors in the numbers can ben identified. Withdrawals, deposits and transactions should all obviously add up and correspond with the corresponding values on the statement. Human reviews of these details lead to significant errors in due diligence, especially when attempted at speed.

Fraud Finder scans the bank statement and turns its transactional data into a ‘JSON File’ which basically adds up the totals, analyses payment sources and ultimately verifies income and financial details... On any document. This is the same as Open Banking verification, but can be used on any financial document even when customers refuse to connect to Open Banking:

As we've already seen, when verifying a bank statement, Homeppl will also run a font analysis test to detect any modifications. We've come across many instances where a single month or bank account balance has been altered to hide real income levels or to fake a payment date. However, common online editors such as ILovePDF or Adobe may not always have the same fonts as mainstream banks and even the slightest difference will fail the font analysis test.

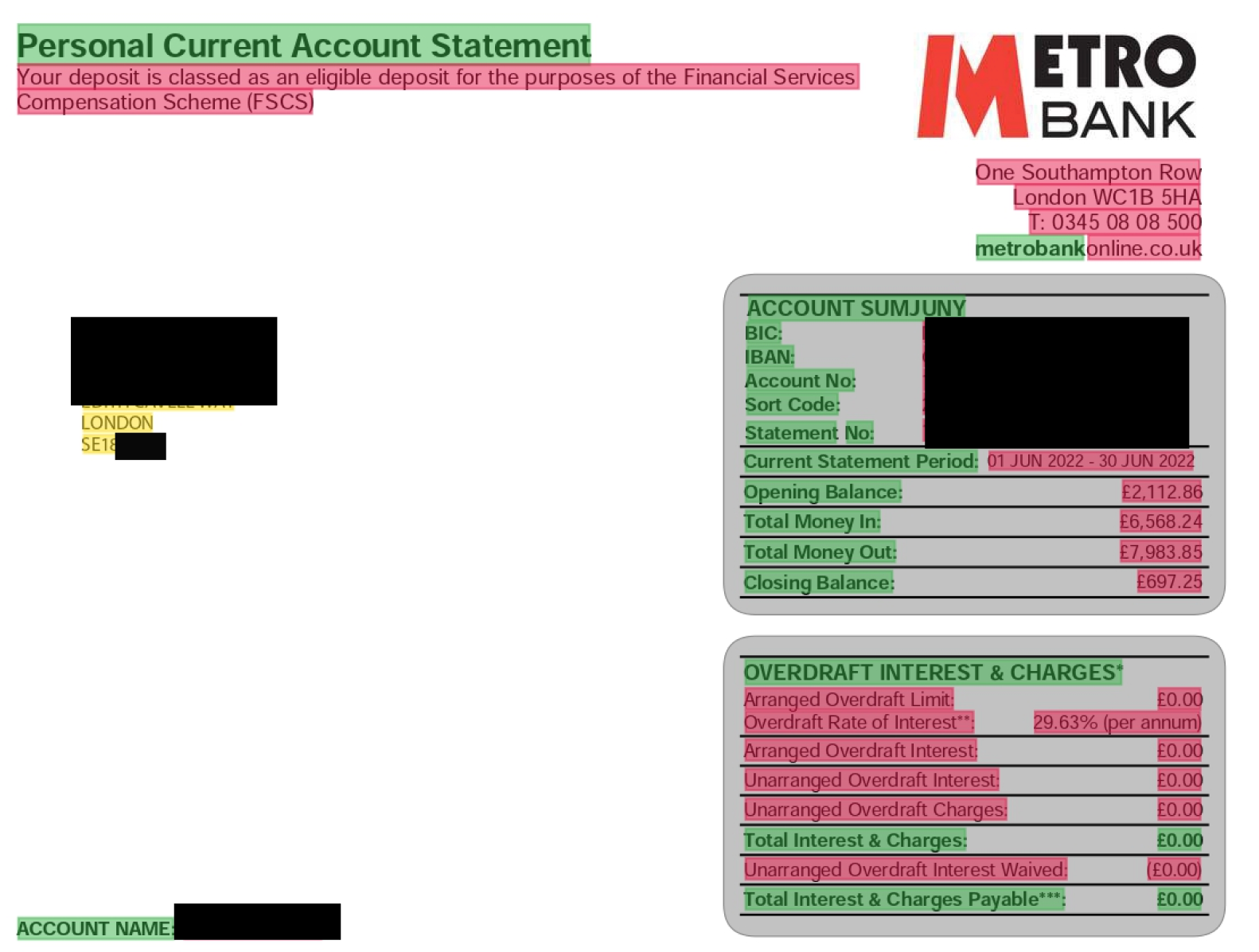

Each different colour represents a different font detected. We can see here that Metro Bank's email address has been poorly doctored as has many of the entries on the account summary table which displays different fonts. This bank statement also includes terrible spelling mistakes!

It is critical to use technology that is able to detect a fake document; especially as fraudsters are becoming more digital savvy. It's not just bank statements we can verify, no our digital ID verification technology can assess the authenticity of passports, payslips, utility bills and other proof of residency/income documents.

Standard tenant qualification practices aren't enough anymore. With Homeppl's document analysis technology, we detect 100% of fraud in documents submitted to our checks.

Using Homeppl's Fraud Finder tool to assess risk in financial documents

Assessing the risk of an applicant has never been so easy. Any applicant, any financial or proof of address document will be analysed. Fraud Finder enriches the financial data provided & offers an instant decision report on affordability and likelihood of fraud.

The tool can be used as a secure online portal or through an API integration and its features include:

Transactions Data: Easily group, compare & analyse bank transactions

Data Enrichment: Gain invaluable financial affordability insights

Account Information Analysis: Retrieve & compare info from documents we standardise (Bank, Sort Code etc.)

Verify Documents: Validate the authenticity of any document

Meta Data Extraction & Analysis: Detect which software was used to create the document

Font Analysis: Discover any irregular fonts that shouldn’t be there

Image X-Ray Analysis: Analyse document structure, highlighting imperfections

QR Code Analysis: Our document checker validates the original source of your document

Try it for free by testing documents for fraud here.

What to read next:

How to spot a fake utility bill

How to spot an edited bank statement

How to detect and prevent application fraud