Affordability assessments made simple

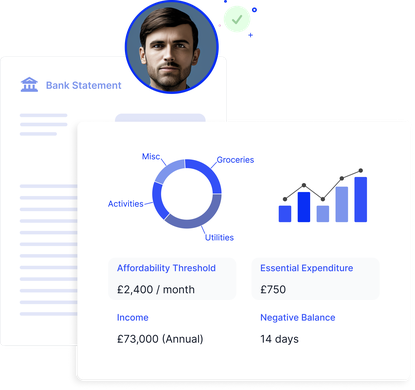

Supercharge your risk decisioning by accessing a comprehensive analysis of consumer income, spending and transactions data.

We’re trusted by the world's leading companies

Self-employed, international & thin-filed applicants struggle to pass credit checks. Our affordability assessments expand financial access.

Only 30% of defaults in the last 12 months are known to Credit Referencing Agencies. Replace data inconsistencies with precise risk decisioning.

Save roughly 200 hours a week in manual assessments of financial documents with our affordability analysis API.

Reduce business costs with instant access to value-added data

More data equals better and faster application decisions.

By automating financial qualification you can onboard more customers more efficiently. Affordability insights are derived straight from applicant bank statements and take seconds to generate.

Understand how we extract data from financial documents >

Bank statement analysis can signal how frequently a consumer is paid and by whom; how often the applicant operates in an overdraft; uses an ATM, has a low bank balance, or spends significantly on gambling.

All financial risk factors should be considered against the current backdrop of economic crisis.

Self-employed and international profiles can find it difficult to access financial products in the UK due to subpar credit referencing checks that struggle to confirm a more complex source of income.

We use Open Banking algorithms that makes verifying multiple income sources at home or across borders simple. If consumers refuse to connect, we can still provide instant verification.

Gain a wealth of granular financial data insights to truly assess affordability. Benefit from a clear report, inclusive of graphs, trends and spending category distinctions to improve your current risk modelling.

challenges we solve

Understanding financial data can be so simple.

“It's quick, professional and comprehensive..”

Robert Nemec, Property Management, Token House

Explore the full power of Homeppl’s technology

Whether you’re looking to reduce fraud loss, onboard customers, make better credit decisions, know more about your customers, reduce operational friction or approve more applications, we have a range of products to serve a range of industries.

Make better credit decisions using new technologies

We'll provide a short no-obligation demo of each element of our fraud tech, book below: