What is document fraud?

Document fraud refers to the act of creating, altering, or using false documents with the intention to deceive and gain something of value such as money, property, or access to restricted areas, financial products or services. It will usually involve the submission of fake documents to financial institutions, government agencies, and other entities. Document fraud is a prevalent crime that occurs worldwide and is often used by criminals to also achieve illegal entry into a country, obtain employment, manipulate banking services, legal services and housing access.

Did you know that according to a recent CIFAS report (The leading fraud crime reporting agency in the UK), 1 in 13 Brits admitted to committing document fraud last year. What's worse, those aged 16-34 were reported to be the age group most likely to do so. Let's delve into why document fraud is so frequent, the reasons why people commit it and how lenders, banks, fintechs and letting agencies can prevent fraud.

Amateur fraud

Amateur fraud occurs when applicants aren’t earning enough to afford the financial product they are applying for and they turn to the following types of activity to secure them.

Common document fraud techniques used by amateurs are fake IDs, including passports and driving licences, and doctored documentation such as fake payslips and fake bank statements. Letters of employment, proof of address such as utility bills and proof of study, as well as fake email and websites to mimic employers and references are all common manipulations by document scammers.

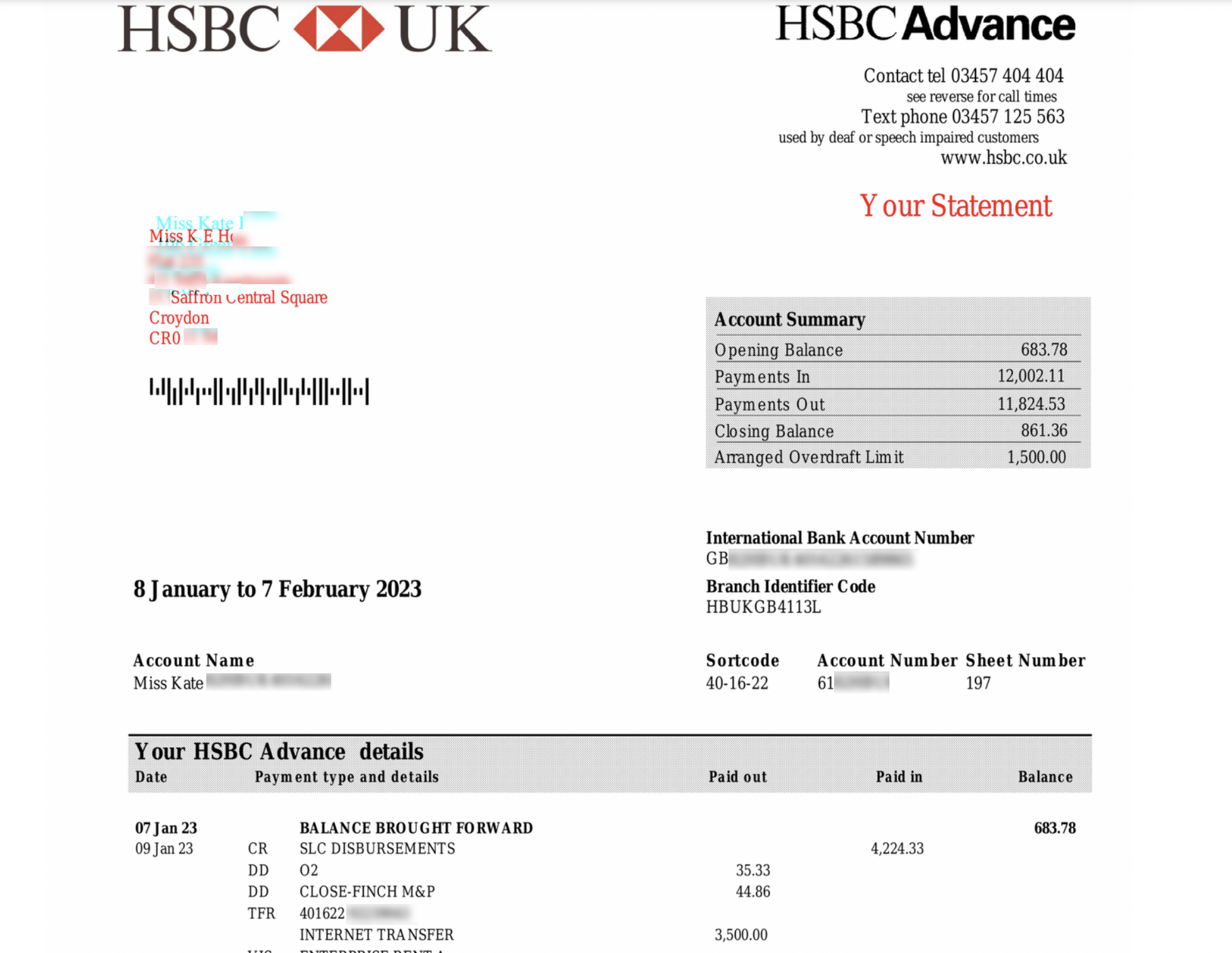

Check out this modified statement that the Homeppl fraud finders team picked up:

Highlighted colours indicate where the statement amendments have been made.

We can clearly see in blue where a different font has been overlayed on to what is the original font marked in red. What does it mean? Why would someone want to change the address and the company that pays her salary? For a number of reasons, including:

Identity theft

Hiding bad credit

Hiding a CCJ

Pretending to be employed to seem financially stable

Our document analysis tool can also uncover every single edit made to a document. Meaning we can see the information people have tried to erase.

We can see that the original bank statement relates to a property in Croydon, not Morpeth as the submitted, edited document conveyed!

You can also see that the inbound transaction is actually from 'SLC Disbursements'. This is payment from The Students Loan company - meaning the applicant is neither employed nor self-employed. But they sure are risky.

Professional document fraud in rentals: subletting

Another type of fraud that has remained prevalent throughout is professional fraud, which is where the tenant is attempting to take possession of a high value property and sublet it through short lets sites such as Airbnb to maximise income whilst defaulting on the rent to the landlord, and it is more prolific in certain areas.

Fraud is even more prevalent for particular agencies as a result of the areas they work in and their client demographic. For one of our London-based agencies, where there are high value properties and a broad tenant demographic, we’ve seen a high number of cases of fraud.

Alexander Siedes, our CEO, explains: “This rise in fraudulent tenant activity has been severely impacting real estate agents and landlords, presenting significant financial risks where, for example, long-term periods of rent are unpaid or the property is damaged.

“It’s vital that agents protect their landlords from fraud - whether it’s amateur or professional - by getting the right systems and tools in place. Otherwise vast amounts of money could be lost.”

Professional document fraud: Identity fraud

Identity fraud involves the unauthorised use of someone else's personal information for the purpose of obtaining goods or services through deception. This may include opening bank accounts, obtaining credit cards, loans, state benefits, or ordering items in the victim's name, taking over existing accounts, or even obtaining official documents such as passports and driving licenses in their name.

It is important to note that the theft of personal information alone does not necessarily constitute identity fraud. It is only when this information is used for fraudulent activities such as those mentioned above that identity fraud occurs. Often, victims only become aware of the crime when they receive bills or invoices for goods or services they did not purchase or when contacted by debt collectors.

With passports, it's always essential to have the latest in biometric technology run over the official travel document. Although passports are difficult to edit, PDFs and images of passports are not. It is the latter that is likely used when submitting an application for finance. 1.3bn consumer applications are submitted globally per year, and up to 10% are affected by document fraud in 2023. Homeppl have a passport ID checker service to help combat identity fraud whilst ensuring companies are KYC/KYB compliant.

Document fraud is a rising issue in the UK

Document fraud is a growing issue in the UK and plays into the wider rising tide of financial fraud overall. One in every 50 tenant applications is fraudulent in the rental sector, rising to one in 20 in London. Up to 10% of financial applications have been found to include some sort of document manipulation. In both cases of amateur and professional document fraud, there is a significant financial and legal risk. Lenders and agents suffer as well as their reputation is usually tarnished if doctored documents are not picked up on in the financial risk assessment process.

Here are the most common types of document fraud plaguing the UK at the moment.

Passport document fraud

One of the most common ways tenant fraud is being committed is by using fake IDs - either by presenting an entirely fraudulent document or by stealing someone else’s ID and then renting the property using that person’s name.

Here's an example of a fake passport:

Homeppl top tip:

Cross-reference driving licenses and passports with external sources to establish not only if the ID being represented is legitimate, but also, if it actually belongs to the person presenting it. Sounds simple, but the volume of fraudulent consumer applications is on the rise and this is the easiest way for fraudsters to kick-start the process. Homeppl's technology detects 100% of fraud and will never miss a fake ID!

Doctored bank PDFs

A method generally used by amateur document fraudsters to exaggerate their income - and therefore their ability to afford financial products - but also by professionals to create a ‘legitimate’ income source, is by editing bank statements.

Homeppl has the functionality to detect the modification date of a PDF and we can cross reference that with the original creation date.

When the dates are different, this tells us the document has been tampered with. Some document fraudsters employ sophisticated methods to tamper with documents, so leveraging technology is key in spotting dodgy statements.

Bogus references from work or previous landlords

A key part of the risk qualification process is obtaining references from employers or previous landlords.

To bypass these checks, fraudsters are not only creating fake references, but entirely fake businesses too. They are purchasing domain names, creating a business website with corresponding email addresses, and then providing these as references. This allows the fraudster to have complete visibility over the referencing process as they are receiving emails as part of the process, ultimately meaning they can fulfil their own reference.

Alternative document manipulation: Payslips

Another method for exaggerating pay or creating a fake reference is to provide doctored or counterfeit payslips. Now that most payslips are digital, fraudsters are able to - as with bank statements - amend these online and create a new version that looks exactly like the original, but with a higher level of pay. Others create entirely fake payslips from fake employers.

Here is a video showing how our technology picks up fake payslips

Our Fraud Finder will conduct a series of tests to verify a payslip, the most simple of which is actually a quick reference check with Companies House. If the company is real, it's important to ascertain whether it has been formed simply to act as a reference. If this is the case, it will most likely have no filing history. Red flag.

Reluctance to connect to Open Banking

Open Banking offers a simple, safe and secure way for consumers to share their banking data in order to speed up the referencing process. So, if an applicant refuses to connect to open banking. Homeppl's transactions data analysis tool can turn any official bank statement into standardised code. This can be used for affordability assessments and as such, effectively turns any document into an open banking-like analysable document, regardless of whether a consumer decided to connect or not!

To sum up document fraud in a nutshell:

Traditional qualification checks use credit reports to verify consumers. Not only does this discriminate against those that do not have traditional credit reports, for example students, internationals and the self employed - but it also leaves one party vulnerable to fraud.

Homeppl is different. We leverage Open Banking and unique fraud detection technology, including data enrichment, behavioural analysis, and document analysis in every single check, enabling us to approve more customers and detect more fraudulent transactions than our competitors resulting in a 0% default rate.